When it comes to managing your company’s payroll, the question arises: should you handle it internally or outsource it to experts? Payroll management plays a crucial role in ensuring the financial health of your business by accurately disbursing salaries and handling tax obligations. From an accounting perspective, payroll management directly impacts a company’s net income due to its close ties to various laws and regulations, with potential penalties looming over errors.

Exploring Payroll Management Services in Dubai

From the perspective of human resources, ensuring accurate and timely payroll distribution is essential for maintaining employee morale. However, managing payroll in-house can be daunting for businesses of all sizes. Errors in paychecks can significantly affect employee satisfaction and hinder the achievement of organizational goals. Moreover, companies need to navigate complex calculations involving taxes, national insurance, and benefits contributions.

Understanding the Difference: In-House vs. Outsourced Payroll Processing

Every business must decide whether to handle payroll internally or outsource it to a payroll service provider. This decision is significant and can have significant cost implications. While some companies prefer to maintain control over their payroll processes and value cost-saving measures, managing payroll internally requires substantial resources and expertise.

The Cost of Payroll Outsourcing

To achieve error-free payroll processing in-house, companies need to evaluate whether they have the resources to meet system requirements, such as operating systems, servers, and trained staff. Alternatively, many businesses opt for outsourcing to alleviate the burden of complex and time-consuming payroll processing. If your company deals with intricate payroll procedures and fluctuating costs every month, outsourcing payroll processing can provide a viable solution.

Benefits of Payroll Outsourcing for Companies

Outsourcing payroll services offers businesses a hassle-free solution for managing their payroll functions. Additionally, it can result in substantial cost savings by avoiding penalties for non-compliance with tax regulations. Outsourcing firms are also adept at staying updated on changes in tax laws, providing valuable guidance to businesses.

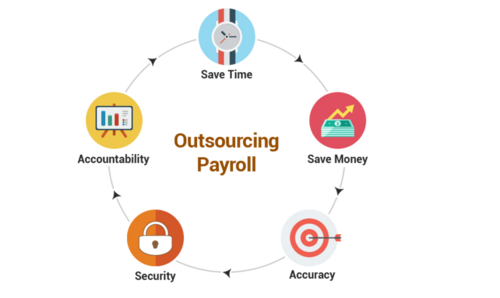

Advantages of Outsourcing Payroll Management

Outsourcing payroll management offers several advantages to companies:

- Reduced Cost: Outsourcing can lead to cost savings compared to maintaining an in-house payroll department.

- Fraud Prevention: Professional payroll service providers can help eliminate fraudulent activities.

- Focus on Core Business: Outsourcing allows companies to focus on core business activities rather than payroll administration.

- Data Security: Outsourcing mitigates the risk of payroll data breaches.

- Expertise on Demand: Access to payroll experts ensures compliance with regulations and efficient payroll processing.

- Compliance Management: Outsourcing firms ensure adherence to legal requirements and regulations.

- Technology Management: Providers handle technological advancements, ensuring efficient payroll processing.

Opting for Payroll Services in Dubai

Flying Colour offers tailored payroll solutions to clients, whether they require comprehensive corporate payroll services or basic processing. Our services include:

- Payroll Data Maintenance: Keeping accurate records of employee payroll information.

- Payment Processing: Handling salary disbursement, including overtime, bonuses, and incentives.

- Pay Slip Preparation: Generating and delivering individual pay slips to employees.

- Coordination with HR: Collaborating with the HR department for seamless payroll processing.

- Bank Transfers: Preparing transfer letters for salary payments to banks.

- Multi-Currency Support: Facilitating payroll processing for international employees.

- Report Generation: Preparing collection reports for financial records.

- Accounting Integration: Ensuring payroll data integrates seamlessly with accounting systems.

- End of Service Benefits: Calculating and managing end-of-service benefits for employees.

- Work Permit Coordination: Assisting with the coordination of work permits for employees.

- Wage Protection System (WPS) Compliance: Ensuring compliance with WPS regulations and providing setup assistance.

In conclusion, the decision to outsource payroll management or keep it in-house depends on various factors, including cost considerations, resource availability, and the complexity of payroll procedures. However, outsourcing payroll can offer significant advantages in terms of cost savings, expertise, and compliance assurance, making it a viable option for businesses looking to streamline their operations.